Financial acumen is increasingly becoming a crucial asset for social enterprise leaders navigating the complex intersection between impact and sustainability. This was the main message of the third virtual training session under the ASEAN Social Enterprise Development Programme 4.0 (ASEAN SEDP 4.0), held on last 10 June 2025. The session, titled “Financial Strategy for CEOs”, was led by Romy Cahyadi, CEO of Instellar Impact.

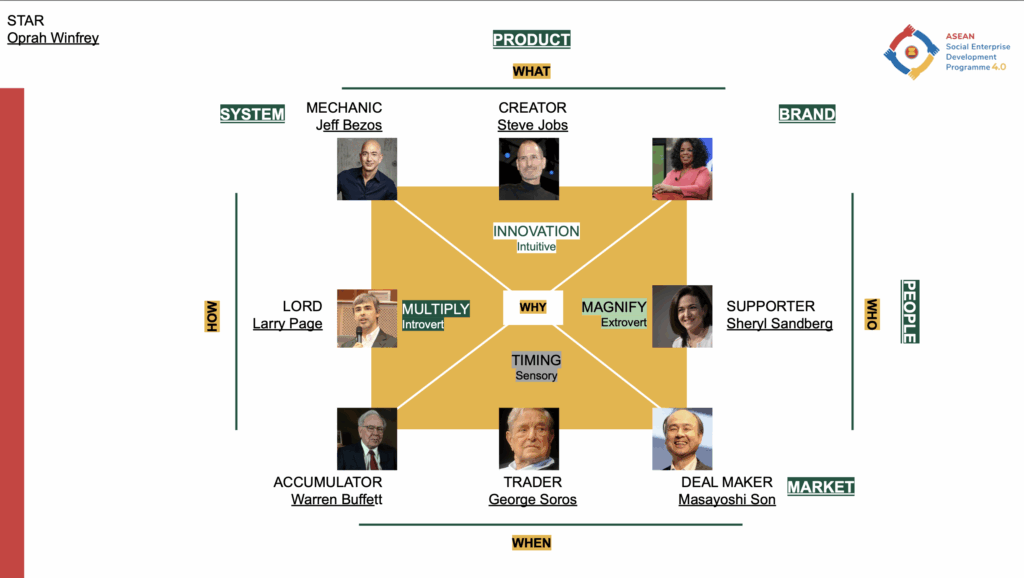

In this session, Romy introduced participants to Wealth Dynamics, a framework developed by Roger James Hamilton. The model outlines eight distinct entrepreneurial profiles that reflect how individuals create wealth, each with its own unique approach and area of strength.

Romy elaborated on each point and provided some examples. The Creator, for instance, focuses on innovation and product development, as exemplified by Steve Jobs. The Star, like Oprah Winfrey, generates wealth through personal charisma and public influence. The Supporter, such as Meta’s Sheryl Sandberg, thrives on team leadership and people management.

Meanwhile, the Deal Maker, represented by SoftBank’s Masayoshi Son, specialises in brokering high-stakes deals, while the Trader, like George Soros, profits from short-term buying and selling strategies. The Accumulator, with Warren Buffett as the prime example, plays the long game through value investing.

The Lord, typically asset-oriented, builds wealth by managing infrastructure and cash flow, as seen in Google’s Larry Page. Finally, the Mechanic, such as Amazon’s Jeff Bezos, creates scalable platforms and automated systems to generate sustainable income.

Beyond the personality profiles, the session also covered fundamental financial documents that every CEO should master: the cash flow statement, income statement, and balance sheet.

“Cash flow is vital for day-to-day decision-making, especially for businesses operating with narrow margins. But the income statement and balance sheet provide a broader view of long-term sustainability and impact,” explained Romy.

For many participants, the session offered a timely moment of reflection. Melissa, CEO of Rustic Borneo, shared her experience in shifting financial focus. “In the early years, we were almost entirely focused on cash flow. But now, six years in, we’ve started looking seriously at income statements and balance sheets. We want to see the results of our efforts more holistically,” said Melissa.

Responding to this, Romy added that in the early stages of running a social enterprise, cash flow is often the top priority to ensure there is enough money to keep operations going day to day. However, having cash doesn’t always mean the business is profitable. At times, a company might show a profit on paper but still struggle with cash availability. True profitability becomes more visible once it’s reflected in the balance sheet, giving a clearer picture of the enterprise’s overall financial health.